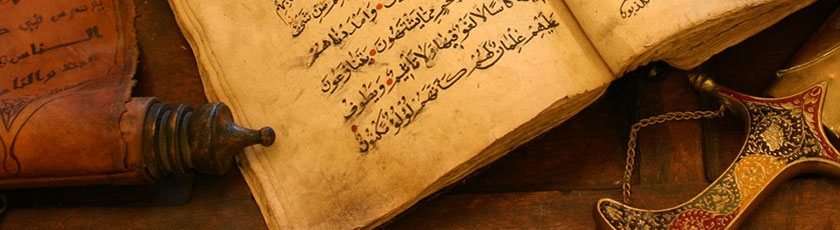

Sunan at-Tirmithiy كتاب الزكاة باب ما جاء أن الصدقة تؤخذ من الأغنياء فترد فى الفقراء

حَدَّثَنَا عَلِىُّ بْنُ سَعِيدٍ الْكِنْدِىُّ الْكُوفِىُّ حَدَّثَنَا حَفْصُ بْنُ غِيَاثٍ عَنْ أَشْعَثَ عَنْ عَوْنِ بْنِ أَبِى جُحَيْفَةَ عَنْ أَبِيهِ قَالَ قَدِمَ عَلَيْنَا مُصَدِّقُ النَّبِىِّ صلى الله عليه وسلم فَأَخَذَ الصَّدَقَةَ مِنْ أَغْنِيَائِنَا فَجَعَلَهَا فِى فُقَرَائِنَا وَكُنْتُ غُلاَمًا يَتِيمًا فَأَعْطَانِى مِنْهَا قَلُوصًا. قَالَ وَفِى الْبَابِ عَنِ ابْنِ عَبَّاسٍ. قَالَ أَبُو عِيسَى حَدِيثُ أَبِى جُحَيْفَةَ حَدِيثٌ حَسَنٌ.

Wahb Ibn-'Abdullāh Abū-Juḥayfah as-Sawā'ī said, "The collector of alms (1) appointed by the Prophet, peace and blessings of God be upon him, came to us and collected the (prescribed) alms from the wealthy among us and gave it to those of us who were poor. I was a young orphan then, so he gave me a she-camel."

(1) (Zakāh): One of the five pillars of Islām: It is a calculated proportion of a Muslim's wealth that is paid annually for the benefit of the needy. It is due on certain assets, once their value reaches a certain threshold and the calculation varies according to the nature of the asset.